Excessive Alcohol Use

Thirty-eight million—or 1 in 6—US adults binge drink about 4 times a month, consuming approximately 8 drinks per binge.9

Excessive alcohol use is responsible for about 88,000 deaths and 2.5 million years of potential life lost in the United States each year.1 Excessive alcohol use cost the US economy $223.5 billion, or $1.90 a drink, in 2006, $0.80 of which was paid by governments.2 Binge drinking (five or more drinks per occasion for men or four or more drinks per occasion for women) is responsible for more than half the deaths, two-thirds of the years of potential life lost, and three-quarters of the costs resulting from excessive alcohol use.2,3

The Prevention Status Reports highlight—for all 50 states and the District of Columbia—the status of the following policies and practices:

- Increasing alcohol excise taxes4

- Having commercial host (dram shop) liability5

- Regulating alcohol outlet density6

These policies and practices are recommended by the Community Preventive Services Task Force because scientific studies support their effectiveness in reducing excessive alcohol consumption and related harms.

Other strategies supported by scientific evidence include avoiding further privatization of retail alcohol sales7 and providing adults (including pregnant women) with screening and brief intervention for excessive alcohol use.8

Policies & Practices

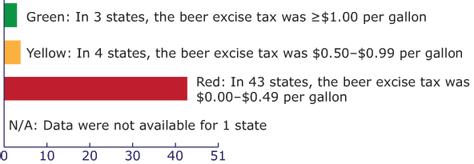

State beer tax

State beer tax refers to the amount of state excise tax, in dollars, per gallon of beer containing 5% alcohol by volume. State beer excise tax does not include any additional taxes, such as those based on price rather than volume (e.g., ad valorem or sales taxes) that states may have implemented at the wholesale or retail level.

The Community Preventive Services Task Force “recommends increasing the unit price of alcohol by raising taxes based on strong evidence of effectiveness for reducing excessive alcohol consumption and related harms. Public health effects are expected to be proportional to the size of the tax increase.”4 The Task Force review found that a 10% increase in the price of beer would likely reduce beer consumption by approximately 5%.4

Status of state beer taxes, United States (as of January 1, 2012)

(State count includes the District of Columbia.)

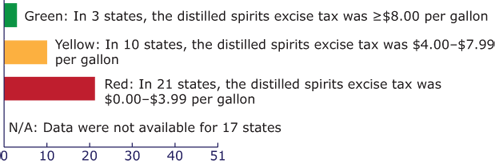

State distilled spirits tax

State distilled spirits tax refers to the amount of state excise tax, in dollars, per gallon of distilled spirits containing 40% alcohol by volume. State distilled spirits excise tax does not include any additional taxes, such as those based on price rather than volume (e.g., ad valorem or sales taxes) that states may have implemented at the wholesale or retail level. For states with different tax rates for distilled spirits sold off-sale (e.g., at liquor stores) and on-sale (e.g., at restaurants), the off-sale tax rate has been reported.

The Community Preventive Services Task Force “recommends increasing the unit price of alcohol by raising taxes based on strong evidence of effectiveness for reducing excessive alcohol consumption and related harms. Public health effects are expected to be proportional to the size of the tax increase.”4 The Task Force review found that a 10% increase in the price of distilled spirits would likely reduce distilled spirits consumption by approximately 8%.4

Status of state distilled spirits taxes, United States (as of January 1, 2012)

(State count includes the District of Columbia.)

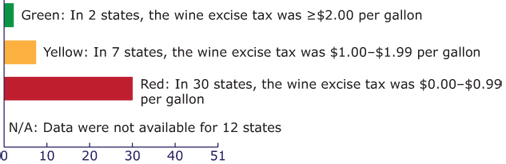

State wine tax

State wine tax refers to the amount of state excise tax, in dollars, per gallon of wine containing 12% alcohol by volume. State wine excise tax does not include any additional taxes, such as those based on price rather than volume (e.g., ad valorem or sales taxes) that states may have implemented at the wholesale or retail level.

The Community Preventive Services Task Force “recommends increasing the unit price of alcohol by raising taxes based on strong evidence of effectiveness for reducing excessive alcohol consumption and related harms. Public health effects are expected to be proportional to the size of the tax increase.”4 The Task Force review found that a 10% increase in the price of wine would likely reduce wine consumption by approximately 6%.4

Status of state wine taxes, United States (as of January 1, 2012)

(State count includes the District of Columbia.)

Commercial host (dram shop) liability

Commercial host (dram shop) liability laws hold alcohol retailers liable for alcohol-attributable harms (e.g., injuries or deaths resulting from alcohol-related motor vehicle crashes) caused by patrons who were illegally sold or served alcohol because they were either intoxicated or under the minimum legal drinking age of 21 years at the time of service. State commercial host liability laws are considered to have major limitations if they 1) cover underage patrons or intoxicated adults but not both, 2) require increased evidence for finding liability, 3) set limitations on damage awards, or 4) set restrictions on who may be sued.10,11

The Community Preventive Services Task Force concluded that “dram shop liability is effective in preventing and reducing alcohol-related harms.”5 For example, the Task Force review found that states with commercial host liability had a median 6.4% reduction in deaths resulting from motor vehicle crashes.5

Status of commercial host (dram shop) liability laws, United States (as of January 1, 2011)

(State count includes the District of Columbia.)

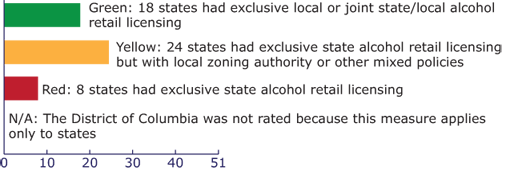

Local authority to regulate alcohol outlet density

Alcohol outlet density refers to the number and concentration of alcohol retailers (e.g., bars, restaurants, liquor stores) in an area. Greater alcohol outlet density is associated with excessive alcohol use and related harms, including injuries and violence.6

Local authority to regulate alcohol outlet density refers to the extent to which a local government can implement zoning (land use) or licensing controls over the number of alcohol retailers in its geographic area. States can limit the authority of local governments to regulate alcohol outlet density, thereby diminishing local governments’ ability to implement this prevention strategy.12

The Community Preventive Services Task Force “recommends the use of regulatory authority (e.g., through licensing and zoning) to limit alcohol outlet density on the basis of sufficient evidence of a positive association between outlet density and excessive alcohol consumption and related harms.”6

Status of local authority to regulate alcohol outlet density, United States (as of January 1, 2012)

Prevention Status Reports: Excessive Alcohol Use, 2013

The files below are PDFs ranging in size from 100K to 500K. ![]()

References

- CDC. Alcohol and Public Health: Alcohol-Related Disease Impact (ARDI) [database]. Accessed Dec 13, 2013.

- Bouchery EE, Harwood HJ, Sacks JJ, et al. Economic costs of excessive alcohol consumption in the United States, 2006. American Journal of Preventive Medicine 2011;41:516–24; and correction, American Journal of Preventive Medicine 2013;44:198.

- CDC. Alcohol-attributable deaths and years of potential life lost, United States, 2001. MMWR 2004;53:866–70.

- Community Preventive Services Task Force. Preventing excessive alcohol consumption: increasing alcohol taxes. In: Guide to Community Preventive Services. Updated Jun 2007.

- Community Preventive Services Task Force. Preventing excessive alcohol consumption: dram shop liability. In: Guide to Community Preventive Services. Updated Mar 2010.

- Community Preventive Services Task Force. Preventing excessive alcohol consumption: regulation of alcohol outlet density. In: Guide to Community Preventive Services. Updated Feb 2007.

- Community Preventive Services Task Force. Preventing excessive alcohol consumption: privatization of alcohol retail sales. In: Guide to Community Preventive Services. Updated Apr 2011.

- US Preventive Services Task Force. Screening and Behavioral Counseling Interventions in Primary Care to Reduce Alcohol Misuse. Updated Oct 2012.

- Kanny D, Liu Y, Brewer RD, Garvin WS, Balluz L. Vital signs: binge drinking prevalence, frequency, and intensity among adults—United States, 2010. MMWR 2012;61:14–9.

- Substance Abuse and Mental Health Services Administration. Report to Congress on the Prevention and Reduction of Underage Drinking. Rockville, MD: Substance Abuse and Mental Health Services Administration; 2011.

- Mosher JF, Cohen EN, Jernigan DH. Commercial host (dram shop) liability: current status and trends. American Journal of Preventive Medicine 2013;45:347–53.

- Mosher JF, Treffers R. State pre-emption, local control, and alcohol retail outlet density regulation. American Journal of Preventive Medicine 2013;44:399–405.

Email Updates

Email Updates STLT Connection

STLT Connection What's New

What's New STLT Collaboration Space

STLT Collaboration Space Field Notes

Field Notes Contact CSTLTS

Contact CSTLTS